News

Wirex: A Simple to Use Fiat to Crypto Bridge Allowing For Crypto Expenditure

Pioneering in the crypto space was Bitcoin in 2009 and three year later, XRP came in view. These were among the very first cryptocurrencies in view and since then, a lot of developments have been made to make these technologies mainstream and most importantly accessible to ordinary investors.

Note than since cryptocurrencies exist entirely in the digital realm, internet penetration is important. With advent of smart phones, internet is accessible to the very remote areas of the planet meaning digital currencies can follow suit.

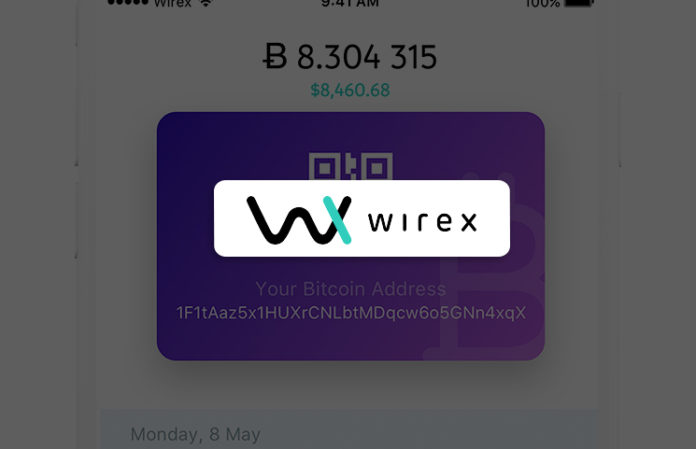

Wirex is one of the world’s leading payment providers devising solutions geared towards crypto mass adoption of Crypto.

About Wirex

Rebranded from E-coin in 2016, Wirex is a London-based payment processing company that combines the inherent properties of blockchain as speed and security with traditional financial systems. The company was founded by Dmitry Lazarichev and Pavel Matveev. Initially, the company began as virtual card provider before introducing Bitcoin debit cards in 2016. They have since expanded their coin offering introducing XRP debit cards in 2018. Through these cards, users can automatically convert their coins to fiat and spend them at any of Wirex supporting stores. There services are available in more than 130 countries except the US because of regulatory impediments.

As an interface between crypto and fiat, it’s important to understand how Wirex operates to avoid unnecessary fees.

Understanding Wirex Fees

Verified users can order for Wirex cards for free but a Wirex virtual card cost $3 while a debit card cost $17 inclusive of shipping. However, the company charges a monthly fee for card maintenance. Maintenance fees are charged irrespective of your transaction activity. Because of this, charges on your card can sometimes exceed zero meaning users have to fund their card before using. If two months of inactivity passes, the company deactivates the card and the account number. Other charges include account and Wirex charges, Top-up charges, Transaction charges and Limits. There are no blockchain fees when sending from one Wirex account to another. But, transfers to third party wallets attract dynamic fees depending on blockchain load.

Wirex Safety

Security is paramount in any crypto wallet system. To safeguard user funds, Wirex employs a couple of security features:

- Two-Factor Authentication: To ensure that approved account holders have access, the company has a 2-factor authentication in place. Here, account holders must login using the correct detail and thereafter input the code sent to the owner’s phone number. Users who login with the correct details but can’t access their phones won’t login.

- Wallet Security: The wallet user is given three private keys stored at different devices for security purposes. Account owners are responsible for the security of their wallet because Wirex never stores or manages user crypto funds.

- Support Security: Aside from the stringent verification process, the company goes ensures that authenticated account users are the only ones who can change two-factor authentication. Their support will reach out once they detect attempts to change phone numbers and other personal details. Additionally, user details are not accessible by Wirex employees.

- Multi signature technology: All Wirex wallets employ BitGo multi-sig technology. This way, fund transfers is only possible once all signatories have approved the transfer. Account users have two or three multi-signature wallets with special codes that they can use for their wallet.

Other Wirex special Features

- Direct conversion from crypto to fiat—USD, GBP, Euro

- Offer Cryptocurrency Debit Card

- Has ShapeShift integration

- Wirex users can transact for free

- Supports over 50 coins